Syed Talat Abbas Shah

Pakistan’s real estate sector has faced growing scrutiny in recent years amid an increase in complaints of property-related fraud. Thousands of citizens across the country say they have lost substantial amounts of money after investing in housing societies and commercial development projects that were later abandoned or left incomplete.

According to analysts, the pattern often begins with developers launching large-scale investment campaigns, promoted through widespread advertising and promises of affordable installment plans and high future returns. Many middle-class families, hoping to secure homes or long-term financial stability, are drawn into these schemes.

However, concerns have been raised that some projects are approved, marketed, and funded without adequate oversight. Victims and experts suggest that weak regulation, combined with alleged influence from powerful networks, has allowed questionable ventures to continue operating for years before problems become visible.

In many reported cases, construction work is suddenly halted, and investors are informed that the company or society has run into financial difficulties or has declared bankruptcy. For those who have invested their life savings, this often marks the beginning of a long and uncertain struggle.

Affected families describe spending years pursuing legal action, approaching law enforcement agencies, and petitioning government departments, often with little success. Some say the process has left them financially devastated, while others report severe emotional stress and hardship.

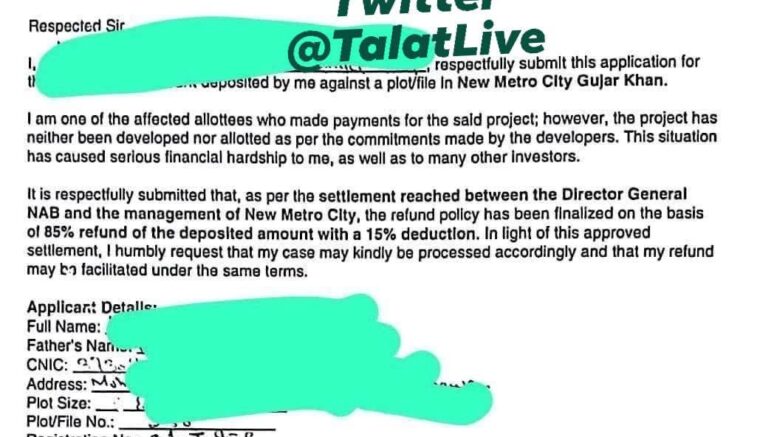

Even when cases reach accountability institutions such as the National Accountability Bureau (NAB), full recovery of lost investments is not always guaranteed. Legal mechanisms such as plea bargains may result in partial repayments, but many victims argue that the system rarely delivers complete justice or compensation.

The situation has sparked wider questions about accountability and governance within Pakistan’s property sector. Critics say the repeated emergence of such scandals risks undermining public confidence, not only in private developers but also in regulatory and enforcement institutions.

There are increasing calls for stricter controls on housing and commercial projects, including mandatory legal clearances before funds can be collected from the public, faster prosecution of fraudulent actors, and stronger protections for investors.

Without significant reforms, observers warn that property fraud could continue to threaten both Pakistan’s economic stability and the trust of ordinary citizens seeking secure investment opportunities.

Be the first to comment on "Real Estate or Ruin? Pakistan’s Fraud Formula Exposed"