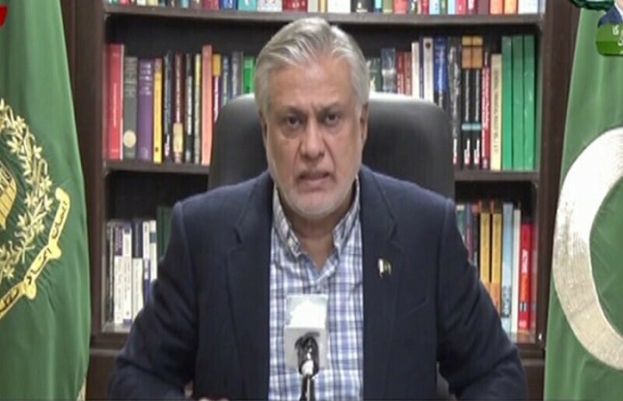

Finance Minister Ishaq Dar clarified on Wednesday that the government would not take over foreign exchange held by commercial banks, saying that his earlier statement on the country’s reserves had been twisted by certain sections.

His remarks come days after he said in an interview that Pakistan’s foreign exchange reserves stand at $10 billion, a much higher figure than the central bank’s $5.6bn reserves as of Dec 30, 2022, because “dollars held by commercial banks also belonged to the country”. This comment gave rise to fears that the government may confiscate dollars from private banks as had been done in 1998 when Dar was the finance minister.

However, Dar said today that his comment was “greatly misconstrued” and “nothing of the sort will happen”.

In a press conference alongside Prime Minister Shehbaz Sharif and other federal cabinet members, Dar elaborated that prior to 1999, every cent that came into the country was deposited with the State Bank of Pakistan (SBP) and private banks were not allowed to keep dollars.

“In February 1999, when I was the finance minister, we devised a system whereby a substantial amount [of dollars] remain with [private] banks. It was on June 30, 1999 that reserves were broken down into three columns — those with the SBP, commercial banks and total.

“Whenever Pakistan’s reserves are quoted anywhere in the world — a survey or a document — the [total figure] is quoted and then a breakdown is given. I gave a breakdown too,” he added.

The minister said “some people” had worsened the country’s situation to the extent that it had slipped from being the 24th largest economy in 2016 to the 47th.

“Even now, they cannot tolerate any good development. They gave such a twist [to my statement],” he said, adding that while the federal cabinet was busy working for Pakistan under PM Shehbaz’s guidance, such people were spreading rumours that the government would take dollars from commercial banks.

“Nothing of that sort will happen. Everything is all worked out … and in order. Nothing to worry about,” he assured, urging those “spreading the rumours” to play a positive national role.

Dar also tweeted about the reserves later, saying national foreign exchange reserves always include forex held with SBP and commercial banks.

“Recently I quoted the forex reserves figure based on this principle. Some vested elements who ruined this country’s economy in the past, gave it a deliberate twist and started a campaign as if govt was considering access to foreign exchange held with commercial banks which indeed is the property of the citizens.

“It is categorically denied and clarified that there is no such move under consideration of the govt,” he emphasised.

The finance minister said the country’s foreign exchange reserves would improve in the near future.

IMF review

Pakistan’s foreign exchange reserves have depleted to an eight-year low of $5.6bn as of Dec 30, 2022, according to the central bank. This amounts to three weeks of imports.

The rapid decline has left no space for the government to pay back its foreign debts without borrowing more from friendly countries. The ninth review of the International Monetary Fund (IMF) programme, which would release $1.18bn, has been delayed for months because of the PML-N-led government’s unwillingness to accept certain conditions placed before it by the Fund.

Dar addressed the delay in today’s press conference, saying that it was related to revenue collection. The super tax imposed by the government in June last year had been invalidated by a high court while the Federal Board of Revenue (FBR) had failed to meet its target in December, the finance minister noted.

He said that his team informed the IMF that Pakistan could recover the amount in a staggered manner after the Supreme Court ruled on the super tax. “We are not changing the fiscal budget target and we will achieve it,” he asserted.

However, the IMF wanted the government to take fiscal measures and cut back some subsidies, Dar added. “We have identified some fiscal measures but there will be no burden on the common man. They will be very targeted and categorical,” he assured.

Govt will not take over commercial banks’ dollars: Dar