The State Bank of Pakistan (SBP) announced on Thursday that it had increased the interest rate by 300 basis points (bps) to 20 per cent — the highest level since October 1996 — citing rising inflation.

The announcement came after a meeting of the bank’s Monetary Policy Committee (MPC).

The central bank said the decision reflected the “deterioration in inflation outlook” and its expectation amid recent external and fiscal adjustments.

“MPC believes this outlook warrants a strong policy response to anchor inflation expectations around the medium-term target of 5-7pc,” it stated.

The SBP noted that the reduction in the current account deficit (CAD) was important but required concerted efforts to improve the external situation, emphasising that any significant fiscal slippage would undermine monetary policy effectiveness in the context of achieving price stability.

According to the SBP press release, the MPC had highlighted in its meeting in January the near-term risks to the inflation outlook from external and fiscal adjustments.

“Most of these risks have materialised and are partially reflected in the inflation outturns for February,” it said. “The national CPI inflation has surged to 31.5pc year-on-year, while core inflation rose to 17.1pc in urban and 21.5pc in a rural basket in February 2023.”

The press release stated that the recent fiscal adjustments and exchange rate depreciation had led to a significant deterioration in the near-term inflation outlook and a further upward drift in inflation expectations.

“The Committee expects inflation to rise further in the next few months as the impact of these adjustments unfolds before it begins to fall, albeit at a gradual pace,” the central bank said.

The SBP also said that “vulnerabilities continued to persist despite a substantial reduction in the current account deficit (CAD)”.

It highlighted that scheduled debt repayments and a decline in financial inflows amid rising global interest rates and domestic uncertainties continued to pressurise the forex reserves and the exchange rate.

“In this regard, the conclusion of the ongoing 9th review under the International Monetary Fund’s Extended Fund Facility will help address near-term external sector challenges,” the central bank said.

The press release added that “barring unexpected future shocks”, today’s decision had pushed the real interest rate into a “positive territory on a forward-looking basis”.

“This will help anchor inflation expectations and steer inflation to the medium-term target of 5-7 pc by the end of FY25,” it concluded.

‘IMF condition’

Commenting on the development, Khurram Schehzad, CEO of Alpha Beta Core, said that the policy rate was aimed at fulfilling the International Monetary Fund’s (IMF) demand.

He also said that the hike to 20pc was last seen in 1996.

Intermarket Securities’ Head of Equity Raza Jafri also agreed that the SBP’s decision coincided with other steps taken to complete the IMF programme.

Expected increase

Pakistan is undertaking key measures to secure IMF funding, including raising taxes, removing blanket subsidies, and artificial curbs on the exchange rate. While the government expects a deal with the IMF soon, media reports say that the agency expects the policy rate to be increased as well.

Earlier, market participants in a treasury bill auction expected at least a 200 basis points increase in the policy rate, which previously stood at 17pc. The expected increase was based on the rates the government set in the auction to raise the funds.

The government raised Rs258 billion in the auction on February 22. The cut-off rates for the three-month, six-month, and 12-month tenors jumped 195 bps, 206 bps, and 184 bps higher than the previous auction.

The SBP has hiked rates by 725 bps since January 2022, with the last rise of 100 bps coming in January. At the time, the bank had said the move was aimed at tackling rampant inflation.

But shortly after that, annual inflation for January clocked in at a five-decade high of 27.5pc.

The recent hikes in gas tariffs and the general sales tax are yet to be incorporated, which is leading to expectations of the CPI jumping close to 30pc in February.

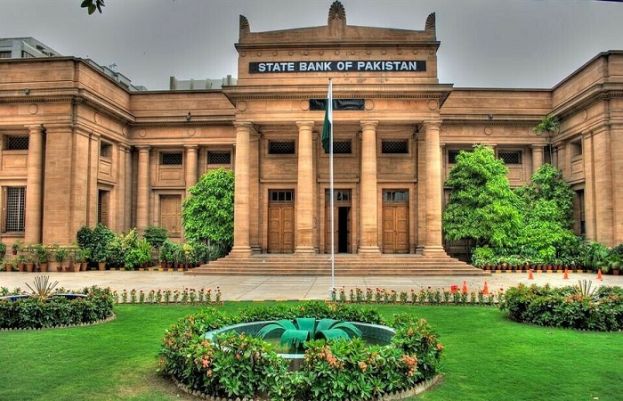

SBP hikes policy rate by 300bps, highest since October 1996